tax break refund unemployment

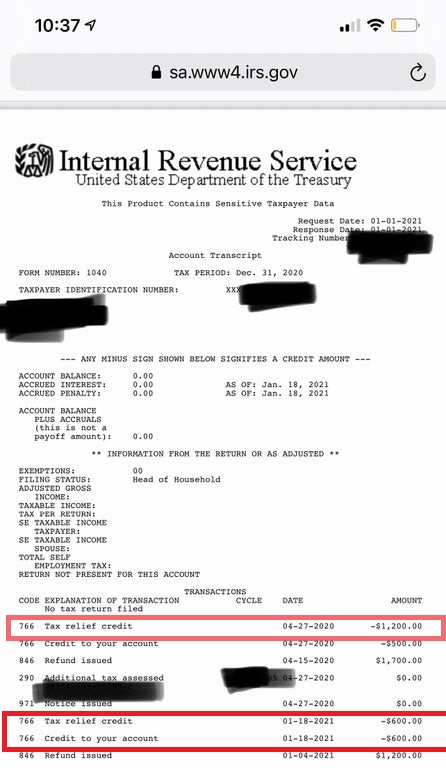

If you received unemployment benefits last yearyou may be eligible for a refund from the IRS. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

This means that you dont have to pay federal tax on the first.

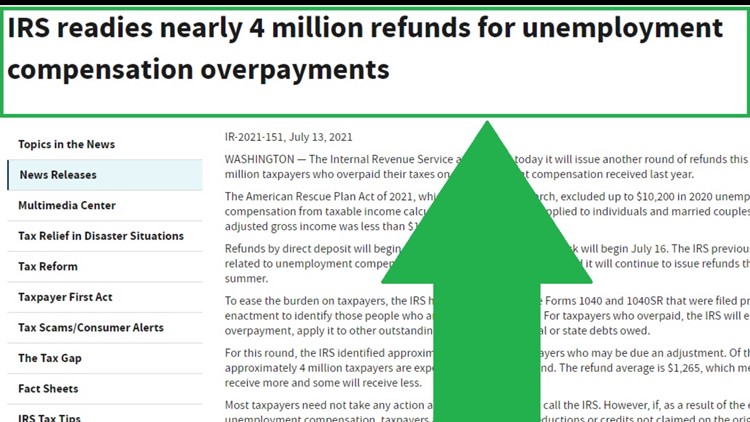

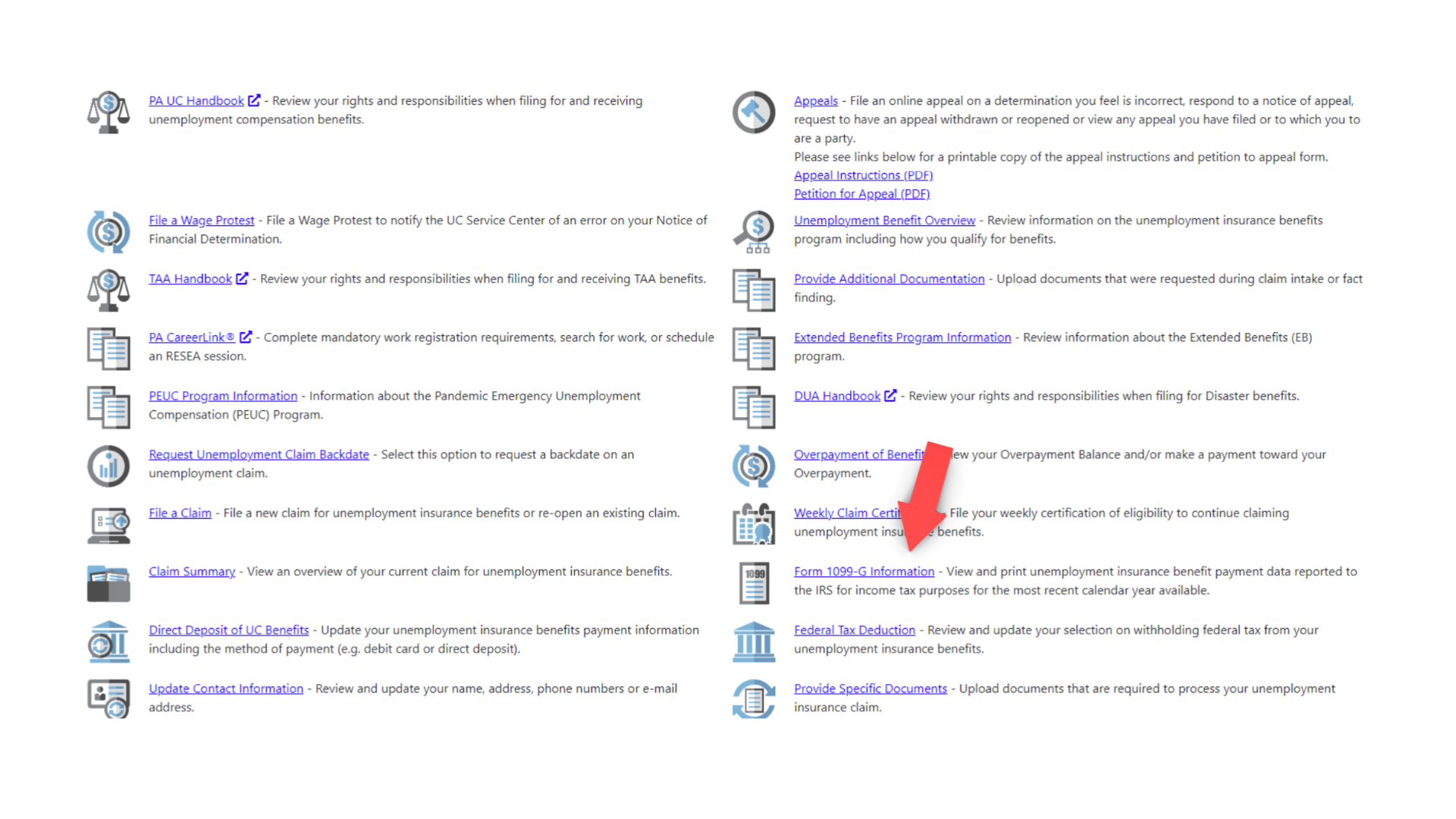

. The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. Total the New York State tax withheld amounts from all IT-1099-UI forms. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to.

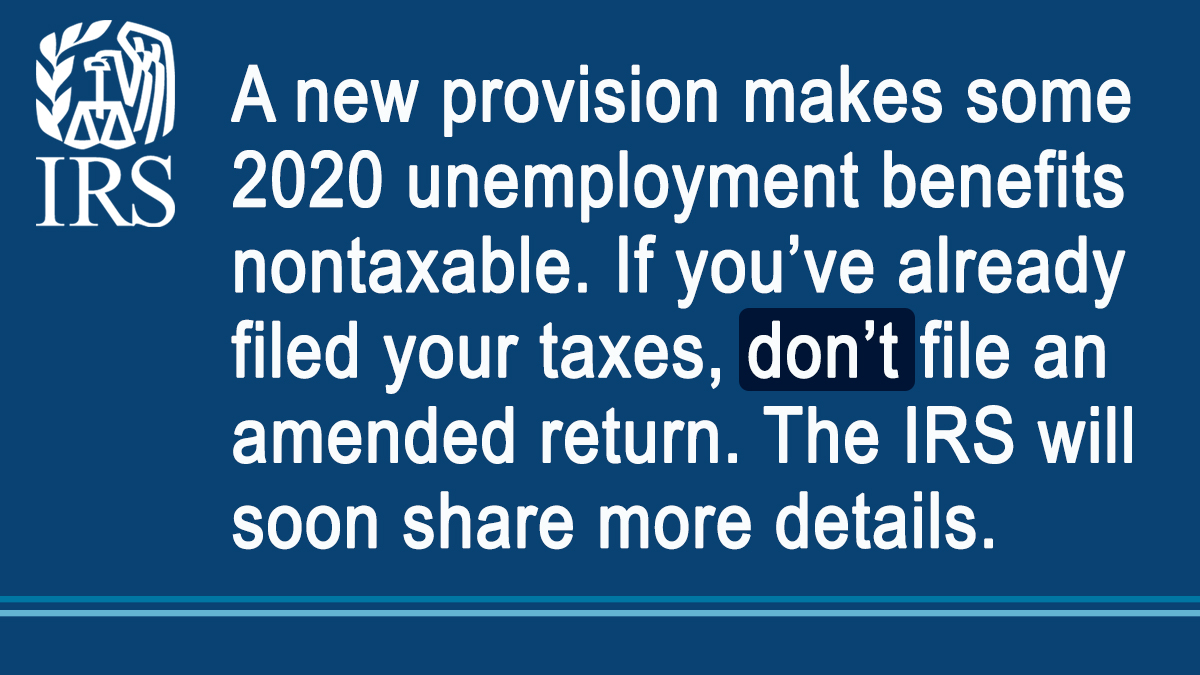

Unemployment Federal Tax Break. When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000.

Property Tax Relief Programs. I filed as soon as I could at the end of January and I still havent gotten anything from the state the online tool to check says theyre still. The IRS has sent 87 million unemployment compensation refunds so far.

The tax agency says it recently sent refunds to another 430000 people who overpaid taxes on their 2020 unemployment benefits. We will begin paying ANCHOR. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally.

The deadline for filing your ANCHOR benefit application is December 30 2022. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT You can receive your unemployment benefits two ways. The legislation excludes only 2020 unemployment benefits from taxes.

Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. The first10200 in benefit income is free of federal income tax per legislation passed. This threshold applies to all filing statuses and it doesnt double to.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. Include this total on the Total New York State tax withheld line on your New York State income tax return. The IRS announced earlier this month that the agency had begun the process of adjusting tax.

Because the change occurred after some people filed their taxes the IRS will take steps in the spring and. What are the unemployment tax refunds. This batch totaled 510 million with the average.

Blake Burman on unemployment fraud.

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

The Ui Tax Refund On My Transcript 1 229 23 Is Less Then The Unemployment Taxes Paid 2 606 Shown On My 1099g Is There Any Reason For This R Irs

Dor Unemployment Compensation State Taxes

Will My Unemployment Benefits Affect My Tax Refund Gudorf Tax

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Taxes 2021 What To Expect For The 2021 Tax Season Tax Foundation

Irs To Handle Some Refunds Relating To Jobless Benefit Mixup In Phases

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds On 10 200 Of Unemployment Benefits Begin This Month In May Who Ll Get Them First Local3news Com

Irsnews On Twitter If You Received Unemployment Benefits Last Year And Already Filed Your 2020 Tax Return Don T File An Amended Return Irs Will Be Issuing Guidance To Address Changes Brought By

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Unemployment Benefits Tax Issues Uchelp Org

Irs Automatic Refunds Coming For 10 200 Unemployment Tax Break

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back